Investor Portal

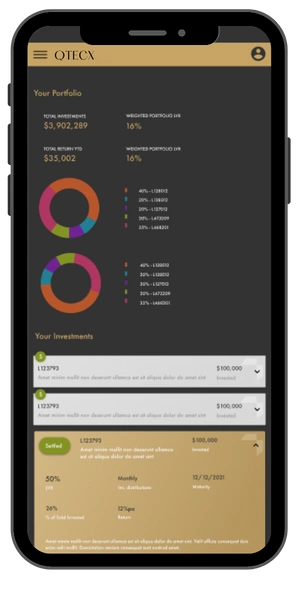

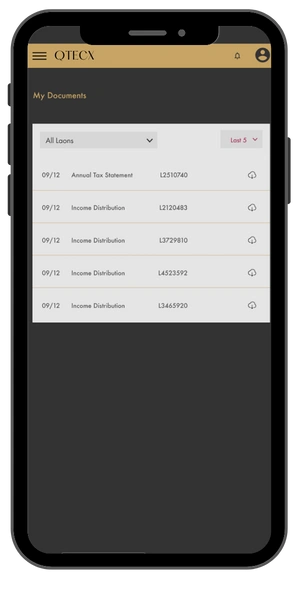

The investment and borrower portal provides easy and secure access to investment portfolio and real-time transaction details. It gives up-to-date performance information, and allows customers to download account statements and forms.

About the Project

The customer a mid sized company in investment space and manages a portfolio of direct investments from investors and borrowers. The borrowers consume loan from the customer for primarily housing and land packages accross Australia. The investors fund the borrowers and are given returns based on their investment potential, and terms defined for each loan/product.

The customer's systems are managed by an internal loan management system called FinPower. FinPower, while robust and advanced is a legacy system primarily designed as a desktop application. The investor and borrower interaction primarily therefore was using offline statements and phone/email updates

QTECX approached Noorix to build an integrated solution that integrates with the legacy loan management system and consolidates a view specific for investors and borrowers in a custom made web and mobile app. This would allow their customers to view their portfolio at a glance, enquire about new opportuntiies, view documents, forms and other transactions in real time with a few clicks.

The Challenge

- Limited Accessibility: Clients and stakeholders couldn't access their accounts and information at their convenience, leading to frustration and reduced client satisfaction

- Operational Inefficiencies and Errors: The reliance on manual processes resulted in delays, increased costs, and a higher incidence of human errors in record-keeping and reporting

- Competitive Edge: Without a digital platform, the company lagged behind its competitors, potentially losing market share and facing difficulties in attracting and retaining clients

- Transmitting sensitive information without a secure portal posed risks of data breaches. Moreover, the absence of streamlined communication tools made interactions less efficient and clear

- Producing client-specific reports was cumbersome. Clients also faced delays in decision-making due to the extended time required to request and receive vital information

The Solution

- Custom build portal and mobile app: With 24/7 access to their accounts and information, clients experienced increased convenience, fostering higher client satisfaction and loyalty.Enhanced Accessibility & Client Satisfaction: With 24/7 access to their accounts and information, clients experienced increased convenience, fostering higher client satisfaction and loyalty.

- Streamlined Operations & Reduced Errors: Automating processes minimized delays and reduced manual intervention, significantly cutting down on operational errors and enhancing efficiency

- Robust Security & Seamless Integration: The portal provided fortified data protection, ensuring sensitive information remained secure. Additionally, its compatibility allowed for smooth integration with other key software systems, eliminating data silos

- Gained Competitive Advantage: By modernizing their infrastructure, the company repositioned itself as a market leader, attracting more clients and retaining existing ones due to the improved user experience

- Data-Driven Decision Making: The portal facilitated real-time reporting and analytics, empowering clients and the company alike to make informed, timely investment decisions

What we delivered

Integration with Loan Management System

We worked very closely with existing technology partner of our client: Full Circle and finPower Connect. Our first challenge was to use and customise APIs that we can use to pull data from loan management solution. The backend system talks seamless with finPower to show (in realtime) investments, historic data and documents seamlessly. To ensure security and minimise the risk of data disclosure, no data is stored on portal's backend. This makes the portal a sort of proxy that extracts clean data to be displayed in dashboards, and formatted view.

Portfolio Management

The portolio overview pulls all data relevant to a customer and aggregates it into a dashboard with key metrics, investment details and relevant transactions. The theme and visualization were customised as per client's corporate theme and seamlessly blends with their website. Historic documents, profile management such as adding bank details, signatories and personal data is also managed through workflows on the portal.

Statements & Documents

All statements, reports and other forms are made available to the customer via the portal. The portal can sends email notifications (optionally) when new statements are published, and/or mobile notification on the app.

Team

Our team consisted of a project manager, s lead architect, a UI/UX designer, 2 developers and a QA engineer. The team worked throughout the first and second phases of the project and was also involved in periodic maintenance and support. We understood the complex project requirements and delivered a high-quality end product that surpassed our client’s expectations.

Technologies

- Angular

- Node JS

- MySQL / RDS

- Capacitor JS

- AWS Lambda

- AWS API Gateway

- Serverless